Form W9 vs. Form W8 BEN: Key Differences and Tax Compliance Guide

- Kader Ameen

- Nov 19, 2024

- 2 min read

Form W9 vs. Form W8 BEN: Understanding the Difference

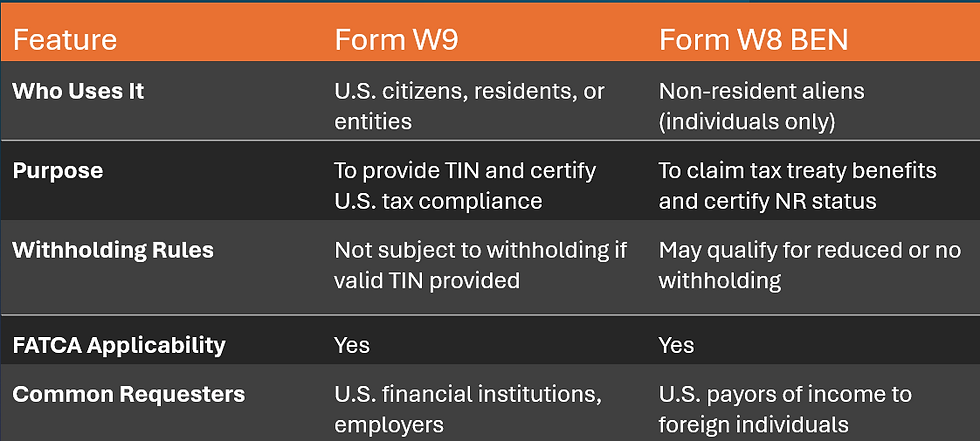

When it comes to U.S. tax compliance, both Form W9 and Form W8 BEN play crucial roles in identifying taxpayers and ensuring proper withholding of taxes. For non-U.S. residents and individuals without a U.S. tax identification number, the ITIN (Individual Taxpayer Identification Number) is essential for completing these forms accurately and avoiding complications.

Understanding Form W9

Form W9 is used by U.S. persons (citizens, residents, and entities) to provide their Taxpayer Identification Number (TIN) to the requesting party. Typically, this form is used when a U.S. individual or entity earns income subject to reporting requirements, such as interest, dividends, or non-employee compensation. It’s commonly requested by banks, employers, and payors of income.

What is Form W8 BEN?

Form W8 BEN is for foreign individuals [i.e Non US Citizens, Non residents with no USA residency] who earn U.S.-sourced income [US Rental income, Royalty income, LLC, K-1 income, Beneficiary of Trust] and wish to claim benefits under an applicable tax treaty. This form is used to certify that the individual is a non-resident alien, exempt from certain U.S. tax reporting requirements, or eligible for reduced withholding on income like royalties or dividends.

What Happens If You Don’t Submit the Forms?

Failure to submit these forms can lead to severe consequences. For Form W9 [Non-USA-based banks [i.e UK, UAE banks may freeze or close bank accounts for non-cooperation by US Citizens], the payor may impose backup withholding on payments made to you. For Form W8 BEN, the default withholding tax rate of 30% may apply without treaty benefits.

Final Thoughts

Understanding the difference between Form W9 and Form W8 BEN is crucial for ensuring compliance with U.S. tax regulations. These forms not only affect your tax obligations but also your eligibility for tax treaty benefits. Whether you’re completing Form W9 as a U.S. person or Form W8 BEN as a foreign individual, understanding FATCA implications, having an ITIN is essential for proper tax compliance and accessing treaty benefits. Ensuring accurate and timely submission of these forms can help avoid penalties, excess withholding, or issues with financial institutions.

We are one of the IRS Enrolled Agent with many years of experience in US 1040/1040NR personal tax compliance reporting and Fatca Compliance FBAR Reporting, We are happy to assist our clients in a timely, efficient, and cost-effective way.

![Tax Refund Not Received for the US Tax Return Filed [1040/1040NR] – Filing IRS Form 3911 May help](https://static.wixstatic.com/media/9bdda2_f98e17af3db74350a7738d6e6adbf5f4~mv2.jpg/v1/fill/w_980,h_628,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/9bdda2_f98e17af3db74350a7738d6e6adbf5f4~mv2.jpg)

Comments